eBay is one of the most popular platforms for beginning online sellers.

It’s one of the oldest eCommerce marketplaces, and most consumers are very familiar with the platform. However, as your eBay sales grow, you have to start taking planning for eCommerce sales tax.

Fortunately, eBay sales tax is easy for online sellers to navigate. We’re going to run down everything you need to know about sales tax on eBay and other e-commerce taxes in this guide, so stay tuned.

eBay Sales Tax: The Basics

If you live in the US, there’s a good chance you need to pay sales taxes on your eBay transactions. The only states in the US that don’t charge sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon. If you sell goods in any of the 45 other sales tax states, you’re responsible for collecting and paying taxes on the applicable tax laws, and the tax rates vary by state.

You need to know where your business has a physical presence or taxable nexus to determine your total sales tax obligations. Fortunately, eBay makes the process a lot easier thanks to marketplace facilitator laws that allow the platform to collect sales tax on the seller’s behalf.

eBay will automatically collect and remit sales taxes for its online sellers. You don’t have to worry about collecting sales tax because eBay does most of the heavy lifting for you.

Does eBay Charge Sales Tax?

eCommerce sales used to escape sales tax scrutiny, but states are wising up. In the past few years, many states have passed new legislation that allows them to impose taxes on online purchases. Now, in most cases, eCommerce sales tax operates almost identically to traditional sales taxes. If your business’s home state imposes sales tax requirements, you’ll most likely have to pay taxes on your eBay sales.

eBay doesn’t charge tax, but most states do. Under Marketplace Facilitator laws, eBay collects sales tax on behalf of the state in many instances. As a result, you could see eBay charging sales tax on your transactions.

What Is the Marketplace Facilitator Law?

Back in 2017, the US Supreme Court made a benchmark ruling that opened up the way for the first Marketplace Facilitator Law. Since then, the laws have become commonplace. Marketplace facilitator laws are designed to make it more difficult for people to avoid sales tax by empowering online marketplaces to charge sales tax for the state. This legislation has successfully forced eBay, Amazon, and other eCommerce marketplaces to collect sales tax on behalf of their online sellers.

Does eBay Collect Sales Tax as a Marketplace Facilitator?

Now, most large marketplaces are required to collect sales tax. In 2019, eBay started collecting sales tax on its platform for a handful of districts. However, many other states have passed marketplace facilitator legislation since then, and the number has now swelled to include 46 jurisdictions as of July 1, 2021. Today, eBay automatically collects sales tax for most eBay accounts and sends the taxes to the appropriate tax authorities.

Prior to the marketplace facilitator ruling, an online seller had to set a tax table on their own if they wanted eBay to collect sales tax for them. This feature required online sellers to input their sales tax rates and determine their tax obligations on their own.

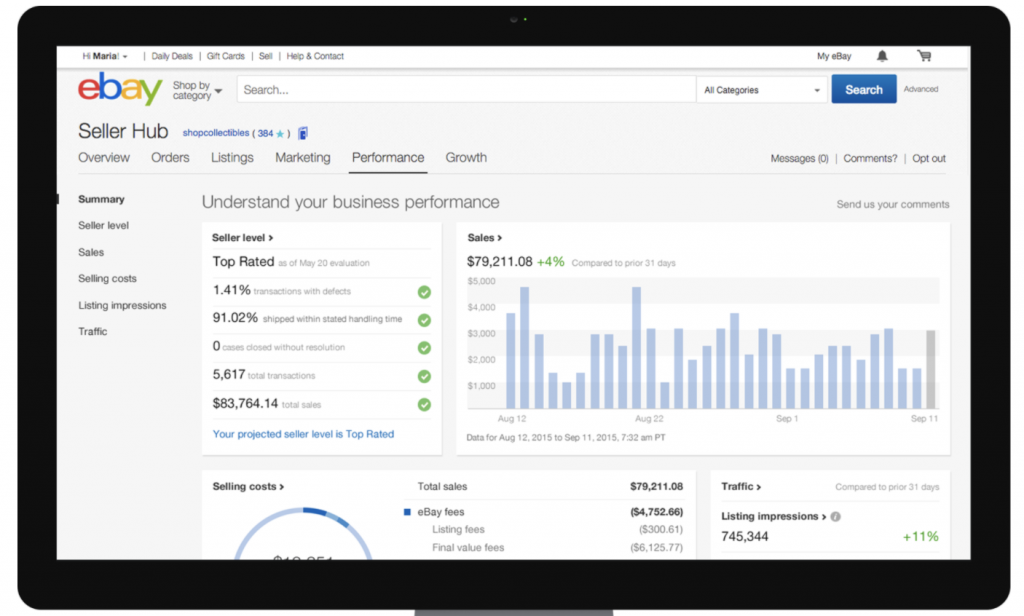

eBay also collects taxes for states with internet sales tax regulations, and it also imposes sales taxes for overseas buyers. eBay sellers can easily view their eBay sales tax collection figures through the sellers’ hub.

Now, in most instances, eBay charges sales tax and remits it on the seller’s behalf. eBay automatically calculating sales tax makes the process much easier on sellers. The platform will impose the proper tax after taking into account the buyer’s shipping address, your physical business’s physical presence, and any additional declared sales tax nexus.

Other eBay Tax Responsibilities

eBay sales tax and internet sales tax regulations seem to be the main point of confusion for most newer sellers, but there are additional tax considerations that shouldn’t be overlooked, especially if your eBay store is your main source of income.

Income Tax

Every US taxpayer has to pay income taxes on their take-home earnings. For most W2 employees, the process is automatic because their employee deducts the taxes directly from their paycheck. However, eBay doesn’t deduct money for any federal tax obligations, so it’s up to you to pay the applicable taxes on your earnings.

Income taxes are usually paid at the end of the year when you file your personal taxes on Form 1040 in April. However, you’ll probably end up with a tax bill at the end of the year, so make sure you’re setting aside some of your earnings to cover the expense. You don’t want to come up short when the IRS is involved.

Your eBay sales will count towards your income totals for the years, so you’ll have to pay applicable income taxes come filing time.

Income tax rates vary according to your income, the number of dependents on your tax return, and other variables, so you will have to consider your personal circumstances to accurately estimate your year-end tax bill.

Self-Employment Tax

If you’ve ever gotten a paycheck before, you know that employers usually deduct Medicaid and Social Security taxes from your wages. Again, eBay doesn’t deduct any federal tax obligations from your check, so you’re on the hook for these taxes as well.

An eBay seller must pay the employer and employee portion of Medicare and Social Security taxes for their sales. The total obligation comes to about 15.3%, and they must make quarterly payments towards their estimated tax obligation throughout the year.

You can learn more about self-employment tax and quarterly estimated tax payments here.

eBay vendors that qualify for self-employment taxes must submit quarterly payments towards their estimated self-employment tax liability throughout the year.

According to IRS rules, anyone who earns $400 or more from self-employed business activities must declare the income on their tax return and pay applicable taxes on the total.

Many professional eBay selling businesses fit into this framework. If you’re just casually selling your own personal items, you probably don’t have to worry about self-employed taxes. However, most serious sellers will easily qualify under these terms.

If your eBay store earns more than the IRS stipulated threshold, you will have some extra tax compliance steps to consider.

eBay 1099-K Form

eBay recently stopped using PayPal as their primary payment processor, and the company now handles most transactions internally. As a result of this change, the IRS now classifies eBay as a payment processor for your tax purposes.

Therefore, eBay doesn’t send out a 1099 Form for every vendor on its platform. Instead, it sends a 1099-K Form to online sellers with sales over $20,000 and more than 200 transactions. If you don’t hit those prerequisites, you won’t receive this form.

However, that doesn’t mean you don’t have to pay taxes on the earnings. You must declare the income on your year-end tax return and pay the appropriate income and self-employment taxes on the funds in question.

Other 1099-K Considerations

The 1099-K form lists all your eBay earnings in one place and is designed to improve voluntary tax compliance. The IRS also receives a copy of your 1099-K form, so make sure your numbers match what’s written on the form.

Sellers who qualify for a 1099-K Form will typically receive the documentation by January 31st in the year following the tax year.

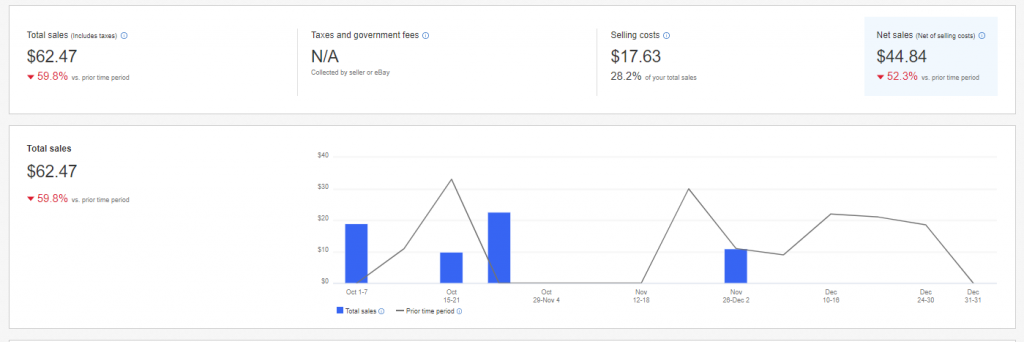

That should give you plenty of time to plan for the tax deadline on April 15th. You can also download your 1099-K form through your eBay seller’s hub.

An eBay 1099-K Form shows payments received for the tax year, including the gross totals and the number of transactions. The form also includes relevant taxpayer information such as your name, address, taxpayer ID, and more.

If you have a particularly successful eBay store, you might receive a 1099-K Form reflecting your earnings. Keep an eye on your mail and eBay seller’s center to ensure you don’t miss it.

Multiple eBay Accounts

If you sell under multiple eBay accounts, eBay will combine your sales and transactions from across all your eBay accounts to form the basis for 1099-K calculations.

eBay counts sales and transactions from all of your stores to determine whether or not you’ll receive a 1099K form. If your combined totals surpass the $20,000 and 200 transaction thresholds, you will receive a 1099K from eBay.

This is an important caveat to keep in mind for prolific sellers. Your individual account totals don’t make the case for whether or not you receive this special tax form. Instead, you should look to your combined account totals to determine whether you should expect to receive this form.

Where to Find eBay Sales Tax Details

The seller’s center on your eBay account is your destination for sales tax on eBay. Here, you can find your gross eBay sales, sales tax collected, your specified tax table, and much more. It’s the best resource for eBay sellers with tax questions.

You can access the seller’s center through your eBay account. It’s an invaluable resource during tax time, so get familiar with the platform. It has all the figures needed to calculate and pay sales tax on your eBay transactions. If there’s ever any issue with your sales tax returns, you can probably find the answers here.

Paying eBay Sales Tax

eBay will collect and remit sales tax on your behalf in most instances. Under marketplace facilitator law, the company is cleared to charge sales for the state tax authorities in most cases. It automatically takes into account the correct sales tax rate for each purchase too, so all you have to worry about is selling.

Most of the time, you don’t need to remit sales tax because eBay is remitting sales tax for you. However, you might find that eBay doesn’t charge sales tax for your state or jurisdiction. In that case, you might have to begin collecting sales tax on your own.

If eBay doesn’t collect sales taxes for your state, your sales tax compliance regimen will become more complicated. You’ll need to manage your sales tax obligations and remit payments to state tax authorities manually.

For more information on state sales tax guidelines, click here.

Here’s what you need to know if eBay doesn’t collect sales taxes for your state.

States with No eBay Sales Tax Collection

eBay doesn’t collect sales taxes for orders to states that don’t have marketplace facilitator laws. As of today, these are the states that fall into this category:

- Florida

- Kansas

- Louisiana

- Mississippi

- Missouri

Since these states don’t have marketplace facilitator laws, they won’t automatically charge sales taxes when you sell to buyers in these areas.

However, sellers with a sales tax nexus in any of the above states still have to collect sales tax from their buyers. The main difference lays in whose responsibility it is to collect the sales taxes. As far as these states are concerned, it’s on the eBay seller to properly calculate and remote sales taxes.

How to Charge Sales Tax for States With No Facilitator Laws?

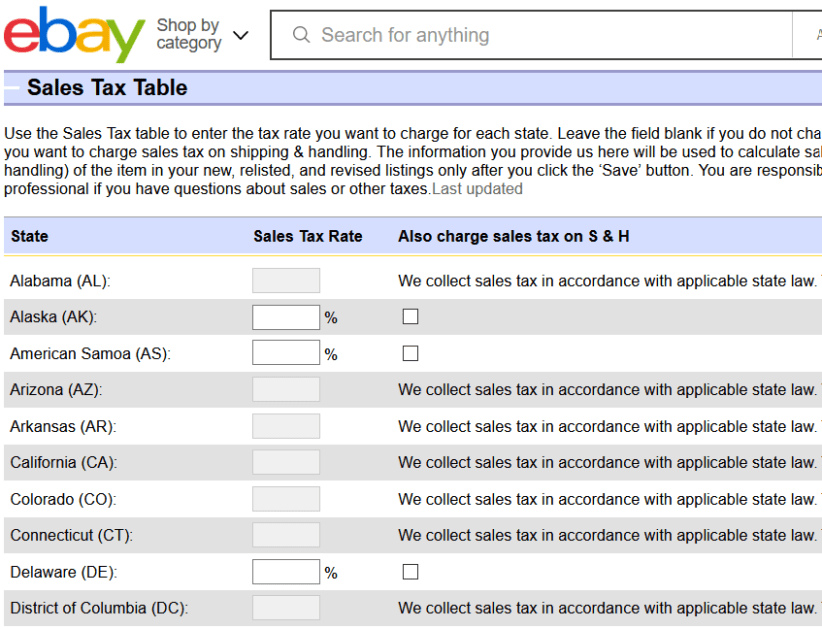

If you need to collect sales taxes from non-facilitator states, you have to update your eBay sales tax table to reflect the necessary taxes for each.

You can access the sales tax table through your seller’s hub and input the correct sales tax rates for each applicable state.

Here’s a screenshot of the eBay sales tax table:

As you can see, eBay allows you to set customer sales tax rates for certain states. Users cannot modify the sales tax rates for states with facilitator regulations, but eBay allows you to set rates for other states.

Once you’ve determined where you have a sales tax nexus, you can set up the sales tax table to charge the necessary sales taxes. Then, it’s your responsibility to file appropriate sales tax returns and submit them to the proper states.

For example, you sell a product to a buyer in the City of Miami. You set your sales tax table to reflect Florida’s statewide 6% sales tax rate, so eBay applies this tax to the total purchase price.

However, Miami-Dade County charges an additional 1% sales tax on top of the state’s tax, bringing the total sales tax rate for the region to 7%. In our example, you have just under-charged your buyer by 1%.

As a result, you’re forced to either under or over-charge your Florida-based customers with eBay’s sales tax collection feature.

You can keep the 6% rate and undercharge your Miami customers, or raise it to 7% statewide and overcharge all your buyers in Florida.

It’s not the most ideal system for sellers, but it’s what they are stuck with for now.

eBay Sales Tax Table Shortfalls

eBay’s sales tax collection features aren’t as comprehensive as other eCommerce platforms. You can set sales tax rates manually, but the platform doesn’t offer destination-based sales tax calculations.

Some localities charge an additional sales tax on top of the state-imposed tax, but eBay only lets you set sales tax rates for the entire state. This limitation can cause some headaches for sellers.

Best Tools for eBay Sales Tax

There are several programs that make it much easier to navigate sales tax on eBay. Avalara and TaxJar are two of the most popular programs for collecting and paying tax on eBay. They integrate seamlessly with the eBay platform and use intuitive tools to make the eBay tax process significantly smoother. No one wants a tax audit at their door, so make sure you give these two tools for collecting and remitting sales taxes a long look.

Avalara

Avalara makes collecting and remitting sales tax a lot easier. Simply input your business information into Avalara, and the software automatically determines if you have a taxable presence in a particular area. Once you’ve determined where your sales tax nexus is located, the software can also help you register for a sales tax permit where it’s appropriate and show you how much sales tax you owe for the year. It can even help you remit your collected sales tax to the proper local tax office.

This handy piece of software makes tax compliance simple. It regularly updates itself with the latest sales tax rates by state, and it also takes into account internet sales tax, value-added tax, and other potential tax obligations. If you’re required to collect sales tax for your online store, Avalara can be a lifesaver and help you avoid tax compliance issues down the road.

TaxJar

TaxJar is also a great option for simplified tax compliance. The platform constantly monitors more than 14,000 tax jurisdictions to ensure the most accurate tax rate for every locality. TaxJar can automatically collect sales tax whenever required at the appropriate tax rate for that particular state.

You can make your life as an online seller a lot easier with TaxJar. It’s an invaluable resource for tax compliance, and it’s a must-have for anyone that’s required to collect sales tax on eBay purchases. TaxJar can also tell you if you’re at risk of developing a sales tax nexus so you can avoid additional tax obligations before it’s too late. It’s an in.

More Tax Advice for Online Sellers

eBay sales tax is simple in its most basic form, but things can get complicated quickly as your business grows. A tax advisor can make a world of difference for many up-and-coming eCommerce businesses.